When it comes to freight management, insurance isn’t just an afterthought—it’s a necessity. You face numerous risks during transit, from damage to theft, and having the right coverage can make all the difference. It protects your business’s bottom line and improves your reputation with clients. But what types of insurance should you consider, and how does the claims process work? Understanding these aspects is essential to safeguarding your shipments effectively.

Overview of Freight Insurance

Freight insurance acts as a safety net for your goods while they’re in transit. It provides extensive coverage against damage, loss, or theft, ensuring you can recover the full value of your shipments during unforeseen events.

This insurance is vital for various transport modes—whether you’re shipping by road, air, sea, or rail, especially if you’re dealing with valuable or fragile items. You should understand carrier liability, as standard policies often offer limited coverage.

Many businesses opt for additional freight insurance to fill these gaps, allowing for improved financial protection. Real-life case studies highlight how freight insurance has helped companies reduce losses, showcasing the importance of having robust coverage in place to strengthen your operational reliability.

Types of Freight Insurance

When it comes to freight insurance, you’ve got three main types to consider: air, sea, and land freight insurance.

Each type is designed to address the specific risks associated with its transportation method, so you need to choose wisely.

Understanding these differences can help you protect your shipments effectively and guarantee smooth operations.

Air freight insurance

Understanding the subtleties of air freight insurance is vital for anyone involved in shipping goods by air. This type of insurance offers critical financial protection against risks like turbulence, theft, and mishandling during transit.

It’s particularly significant for high-value or fragile items, ensuring you receive reimbursement for the full value of goods lost or damaged. Air freight insurance typically includes various coverage options, such as all-risk coverage, which protects against most physical losses, barring specific exclusions.

With the global air cargo insurance market projected to grow, it’s important to grasp the unique risks associated with air transport, like weather disruptions and airport security issues, to select the right air freight insurance policy for your needs.

Sea freight insurance

Air freight insurance offers significant protection for goods transported by air, but sea freight insurance is similarly important for shipments over water. This type of insurance provides essential coverage against risks like sinking, collision, theft, and cargo jettison.

You can choose between all-risk coverage, which protects against most physical losses, and named perils coverage, which covers only specific risks. In 2022, the marine insurance market reached around $25 billion, highlighting the demand for sea freight insurance in international trade.

If you’re shipping high-value or fragile items, this insurance guarantees you receive financial protection, compensating you for the full value of your goods in case of unforeseen incidents during transit.

Land freight insurance

While traversing the complexities of freight transport, having land freight insurance is critical for protecting your goods during overland journeys. This insurance covers risks such as accidents, theft, and adverse weather, ensuring you’re safeguarded from financial losses that may arise.

Various coverage options are available, including all-risk policies, named perils, and contingent insurance tailored to your specific needs. Since land freight accounts for a significant portion of global logistics, understanding the limitations of carrier liability is fundamental. Their compensation often falls short of covering your goods’ full value, making additional land freight insurance necessary for improved security.

Plus, this insurance extends protection during loading and unloading operations, providing thorough coverage throughout the shipping process.

Understanding Coverage

When you’re looking at freight insurance, it’s essential to understand the coverage limits and common exclusions that may affect your policy.

A thorough review of your insurance can help you spot potential gaps in protection that could lead to unexpected losses.

Knowing what’s covered and what’s not guarantees you’re adequately prepared for any risks during transit.

Coverage limits

Understanding coverage limits in freight insurance is essential for protecting your shipments effectively. These limits define the maximum amount your insurer will pay for a loss, helping you understand the financial protection available for your goods during transit.

The value of your cargo directly impacts the coverage limit you choose, so assess your shipments to select insurance that matches your financial exposure. Furthermore, different modes of transport may have varying coverage limits, so it’s important to know the specifics for marine, air, or land shipments.

Engaging with experienced insurers can guide you in steering through policy terms and setting realistic coverage limits, ensuring you lessen financial risks in your freight management strategy.

Common exclusions

Although cargo insurance provides vital protection for your shipments, it’s important to be aware of common exclusions that can impact your coverage.

For instance, damage from inherent vice—issues arising from the natural characteristics of goods—isn’t covered. If your cargo suffers losses because of improper packaging, you’re likely out of luck, as these typically aren’t included in the insurance coverage.

Moreover, willful misconduct or intentional damage by you won’t be compensated. Unexplained losses that occur while the cargo’s under your control likewise won’t qualify for claims.

Finally, if your cargo sits in storage for over 72 hours, you may face exclusions, emphasising the need for timely transportation and delivery to maintain your insurance coverage.

Importance of thorough policy review

Although you might assume your insurance policy covers all potential risks, a thorough review is essential to guarantee your freight operations are truly protected.

By examining your insurance policies, you can identify coverage details that may not adequately address threats like theft, damage, or natural disasters. Understanding specifics like exclusions and limitations helps you pinpoint gaps that could lead to significant financial losses.

Policies vary—some offer all-risk coverage for extensive protection, while others provide named perils coverage, which is more limited.

Regularly evaluating and updating your policies guarantees they evolve with changing risks, especially with the rise of e-commerce.

Working with experienced insurance agents can tailor your coverage to fit the unique needs of your freight management strategy.

The Claims Process

When you encounter damage or loss, knowing the claims process is essential for a successful recovery.

Start by documenting evidence and notifying the carrier right away to strengthen your claim.

Understanding the steps and common challenges can help you navigate this process more smoothly.

Steps involved in filing a claim

Filing a claim can seem intimidating, but understanding the steps involved can simplify the process.

To start the claims process, notify your insurer and the carrier about any damage or loss immediately, following your policy’s timeframes.

Next, gather and document all relevant evidence, like photographs, receipts, and inventory lists, to support your claim effectively.

It’s essential to review your cargo insurance policy thoroughly to know your coverage specifics and any exclusions that might impact your claim.

Once you have everything ready, submit the claim to your insurer with the required documentation, ensuring all information is accurate.

If needed, engage in negotiations with your insurer, referencing policy terms to seek fair compensation for your loss based on the evidence you’ve provided.

Tips for a successful claims process

Successfully managing the claims process can save you time and stress. Start by thoroughly understanding your insurance policy, which helps you navigate any exclusions and requirements.

If damage or loss occurs, document everything with photographs and receipts to support your claim effectively. Notify the carrier immediately after an incident; prompt reporting can positively influence the claims process.

Additionally, inform your insurer without delay to initiate your claim and adhere to any time limits in your policy.

Finally, engage in negotiations for fair compensation. Use the evidence you’ve collected and your knowledge of the policy terms to advocate for your interests.

Following these tips will improve your chances of a successful claims process.

Common challenges in claims resolution

Though traversing the claims resolution process can seem straightforward, several common challenges often complicate matters.

First, you need to notify your insurer without delay, as delays can jeopardise your eligibility for compensation. Documenting evidence of damage or loss is essential; without clear photographs and shipping records, your claim may falter.

Engaging with the carrier right after an incident is vital since they’ve their own reporting timelines. Complications arise from policy exclusions, such as inherent vice or improper packaging, which can lead to unexpected denials.

Finally, effective negotiation skills are often necessary to navigate the claims process and secure fair compensation based on your policy’s specific terms. Understanding these challenges can help you prepare better for potential claims.

Necessity of Cargo Insurance

When you ship goods, the necessity of cargo insurance becomes clear, as it protects your shipments from physical loss or damage during transit.

Cargo insurance is critical for safeguarding against various risks, including theft, accidents, and natural disasters that can occur during air, sea, or land transport.

With the global cargo insurance market expected to grow significantly, it’s evident that thorough coverage is vital for businesses involved in international trade and e-commerce.

Tailored policies guarantee that logistics companies align their insurance with specific operational needs, providing adequate protection against unique supply chain risks.

Business Benefits of Freight Insurance

The peace of mind that comes with freight insurance is invaluable for businesses managing the complexities of shipping. By providing financial protection against significant losses, freight insurance goes beyond basic carrier liability, ensuring you’re compensated for lost or damaged goods.

As the global cargo insurance market continues to grow, recognising the importance of thorough freight insurance is crucial, especially amid the rising shipping risks of e-commerce. When you utilise freight insurance, you not only safeguard valuable items but also improve customer relationships through guaranteed safe deliveries.

Moreover, efficient handling of claims helps maintain operational continuity, allowing your business to navigate disruptions smoothly. Ultimately, investing in freight insurance strengthens your overall shipping strategy and nurtures trust with your customers.

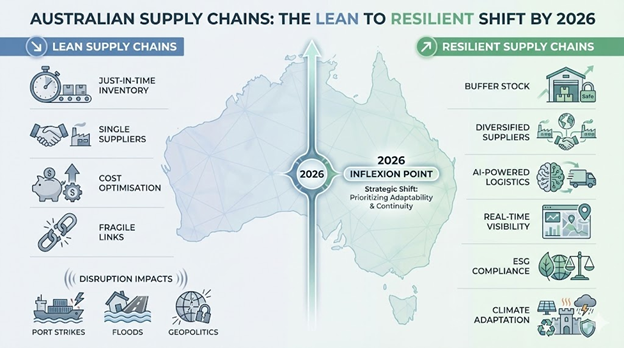

Challenges in Australia’s Transportation Landscape

Steering through Australia’s transportation scenery presents unique challenges that can significantly impact freight management.

The vast distances often mean freight transport covers thousands of kilometres across remote regions, where reliable insurance coverage for cargo becomes vital.

Extreme weather events, such as bushfires and floods, can disrupt logistics operations, highlighting the risks associated with transporting goods in such conditions.

Moreover, regulatory complexities require you to navigate specific insurance mandates for certain shipments, adding another layer of challenge.

The COVID-19 pandemic further emphasised the need for robust insurance solutions to protect against supply chain disruptions.

Finally, cargo theft remains a serious concern, with reported incidents leading to millions in losses, making cargo insurance imperative for safeguarding your shipments.

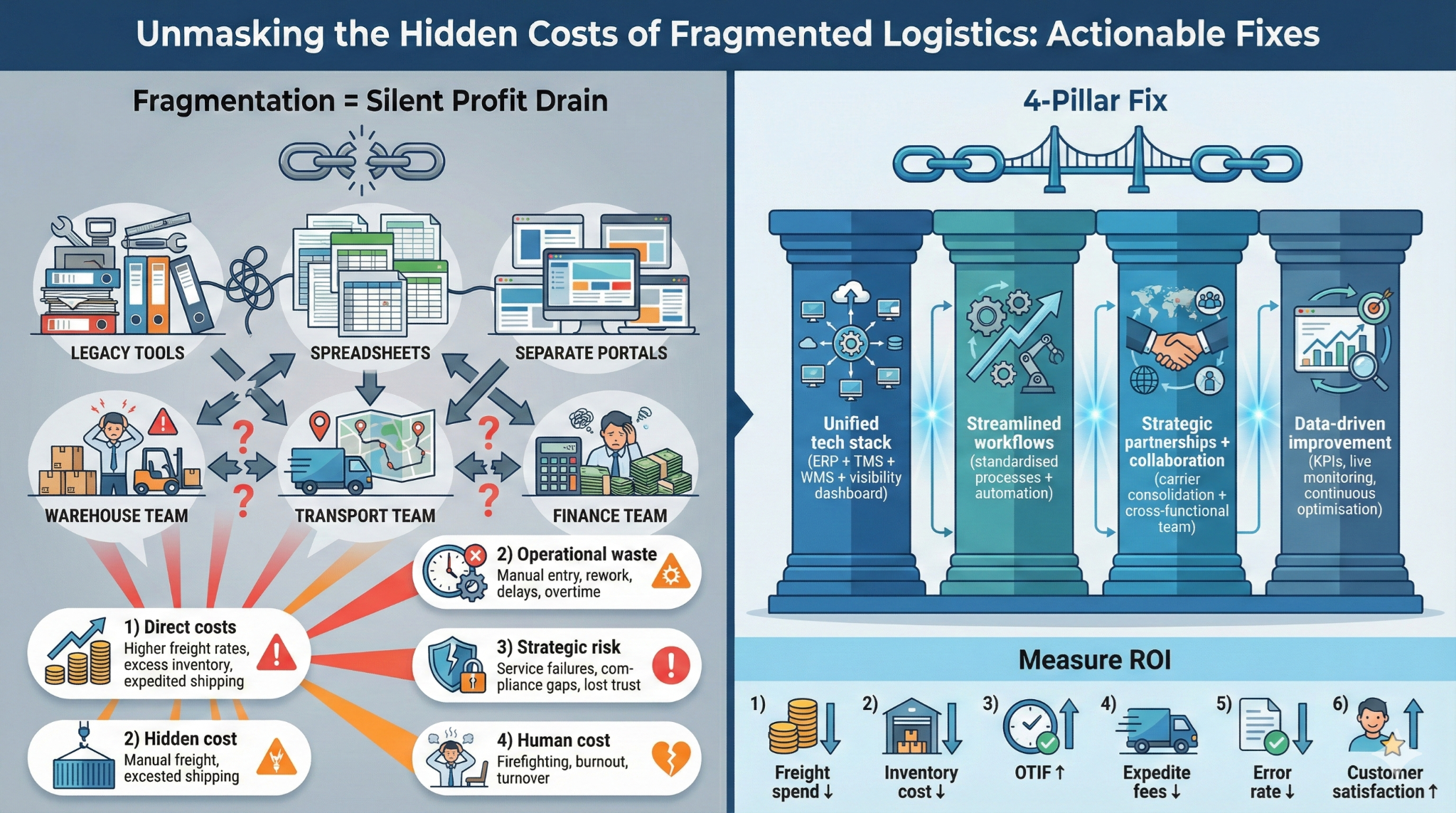

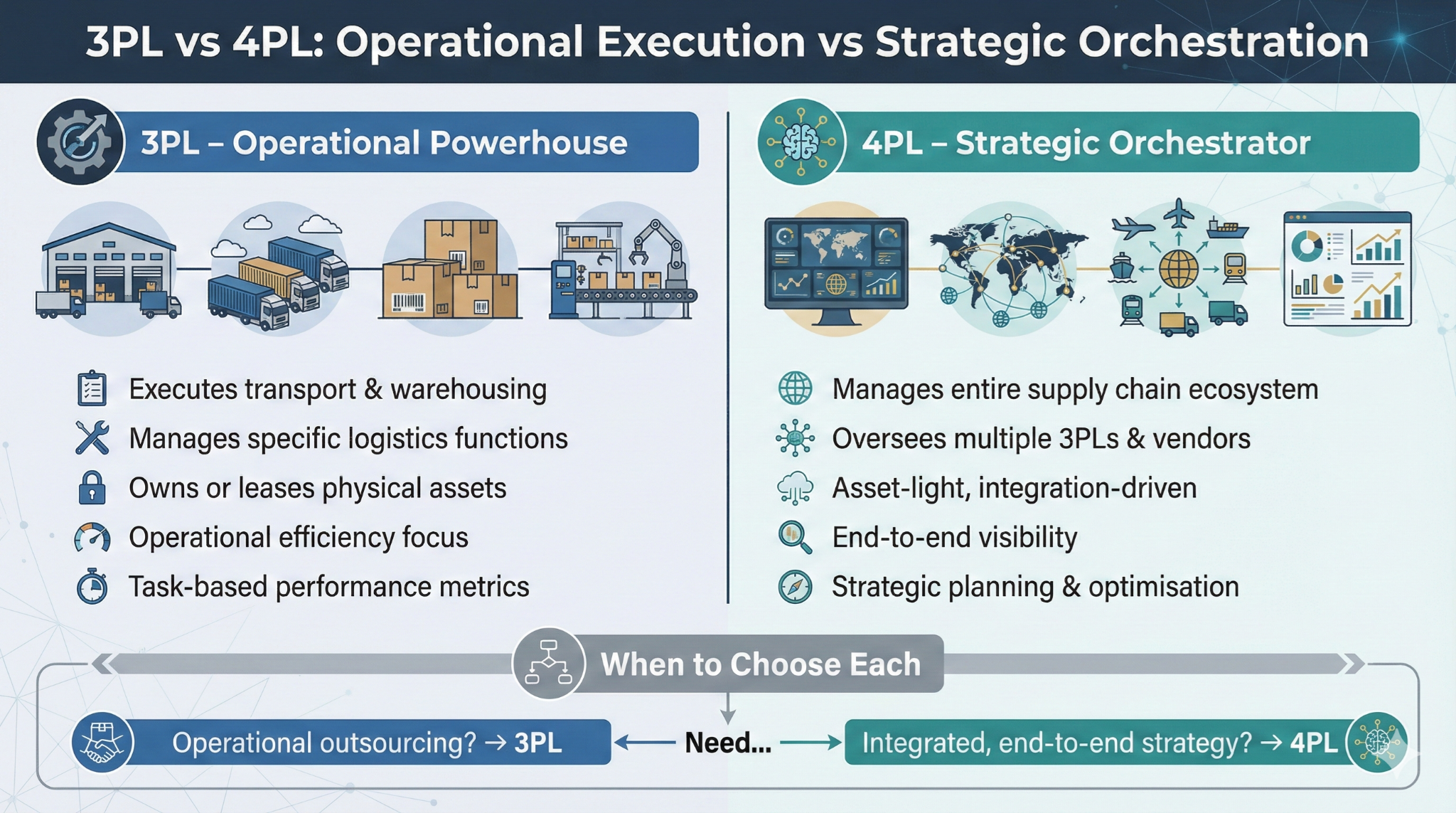

Integrating Insurance into Freight Management Strategies

Integrating insurance into your freight management strategy isn’t just a precaution; it’s a fundamental necessity for safeguarding your shipments.

With the global cargo insurance market projected to grow significantly, the risks associated with logistics operations are increasing. You need to assess your specific insurance needs based on the nature of the goods you’re transporting, identifying any coverage gaps in basic carrier liability policies.

Tailored insurance solutions, like all-risk or named perils coverage, can help protect you from financial exposure resulting from accidents or theft. Collaborating with experienced insurance brokers guarantees compliance with regulations and optimises your insurance costs.

Conclusion

In freight management, insurance is your safety net, catching you when the unexpected happens. Imagine a tightrope walker—without a net, the fall can be catastrophic. Just like that, cargo insurance protects your business from significant losses, ensuring you land safely regardless of whether something goes wrong. With e-commerce booming, investing in thorough freight insurance isn’t just smart; it’s vital for maintaining trust and reliability with your customers while manoeuvring through Australia’s complex transportation environment.