International freight forwarding in 2026 is less about who can book space, and more about who can control complexity.

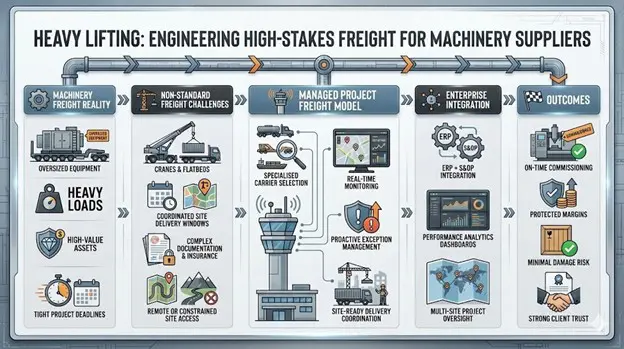

Global supply chains haven’t returned to the predictability many expected. Capacity still tightens without warning. Congestion moves from port to port. Weather, geopolitics and labour disruptions ripple quickly across regions. In this environment, choosing a freight forwarder based purely on price or transit time is a risk.

What matters now is how a forwarder behaves when things don’t go to plan.

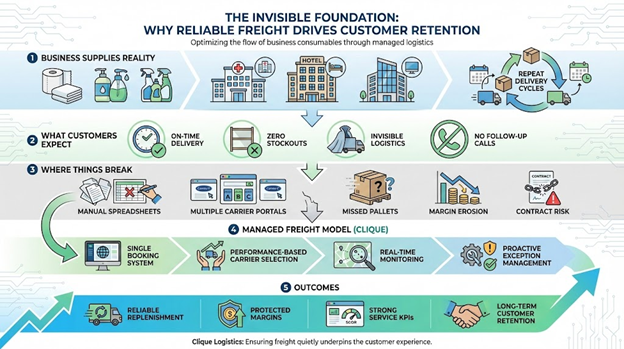

A capable freight forwarder in 2026 should demonstrate ownership, not just coordination. Booking freight is transactional. Managing risk across suppliers, ports, carriers, customs and final delivery is operational. The difference shows up at the handover points — where most international freight issues actually occur.

One of the most important things to look for is clarity of responsibility. Who owns documentation accuracy? Who is monitoring congestion risk? Who communicates when a vessel is rolled or a flight is delayed? If responsibility is fragmented, accountability disappears.

Visibility is another critical factor. Not tracking for the sake of tracking, but visibility that supports decisions. A forwarder should be able to explain not just where your freight is, but what risks exist and what actions are being taken to mitigate them.

Experience across gateways also matters. International freight forwarding isn’t uniform. What works through one port may not work through another. A forwarder operating through multiple gateways needs to understand seasonal pressure, cut-off volatility and how international delays flow into domestic networks.

Equally important is how the forwarder integrates with your business. International freight doesn’t sit in isolation. It affects inventory, production, customer commitments and cash flow. A strong forwarder understands that context and manages freight accordingly.

In 2026, the best freight forwarders don’t promise perfection. They promise control, transparency and proactive communication.

That’s what reduces risk — and that’s where the real value sits.